Dr Martin Turner, Head of Policy and Public Affairs at the BioIndustry Association, on a fantastic year for investment in the UK life science ecosystem.

Biotech fundraising is cause for celebration but is the City listening?

04 Feb 2019

Amongst the gloom of our current political stalemate, the BioIndustry Association’s latest report sheds light on the UK biotech sector’s fundraising success in 2018.

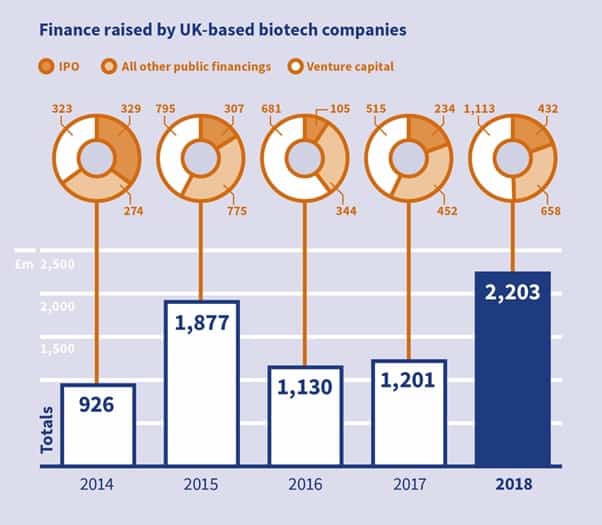

Last year, the sector raised over £2.2bn in capital to finance R&D and business growth. That’s £1bn more than in 2017 and over £300m more than the previous record set in 2015.

We’ve called the report Confident capital: backing UK biotech because the data shows global investors remain confident that UK science can deliver innovative new treatments and technologies for patients and financial returns for shareholders in the long-term.

Even more welcome is the fact that UK companies accounted for over 40% of the total capital raised for biotech in Europe. The UK is by far the leading European life sciences cluster and is third globally behind America and China.

The strong fundraising we see is evidence that the Government’s Industrial Strategy, which has prioritised life sciences, is working. The commitment to raise public and private investment in R&D to 2.4% of GDP signals to investors that the UK will remain a great place to locate science-based companies. The Government is increasing public investment but CaSE’s analysis suggests business investment will need to increase by £8bn in 2027, an ambitious 33% from 2017 levels.

This is where the Treasury’s Patient Capital Review is critical. Launched in 2017, it aimed to increase companies’ access to long-term finance for companies. This is important because in order to invest in R&D, companies need capital from investors.

The review introduced welcome improvements to venture capital tax incentives and provided £4bn to the British Business Bank to catalyse venture capital investment. It also committed the Government to work with the pensions industry – which takes little interest in early-stage businesses at present – to unlock some of the £1tn of funds they hold to invest in innovative young companies. Even a small proportion of those funds could be game changing for UK science and engineering.

We know a lot of the investment in biotech comes from abroad, particularly America and China. That’s positive, but we must look at why the wealth of the City of London, including UK pension funds, isn’t investing. Changing their risk-averse behaviour won’t be quick or easy (the financial sector looks even more complicated than the science sector from where I’m standing!) but ensuring our science-based companies are well-funded is essential to achieving the 2.4% target and maintaining the UK’s position as a science superpower. £2.2bn is good – great, even – but we need more if we are going to hit that target.

The Government needs to keep doing what works – funding basic research, R&D tax credits, and Innovate UK grants – and look for new ways to get more investors backing UK biotech and other science-based sectors. Collective investment vehicles might be one solution, building on the success of funds like the Wellcome Trust’s Syncona; optional “UK innovation funds” on auto-enrolment pensions might be another. And we as the industry must do more to demystify our sector and promote investment opportunities.

It takes great science, people, and money to build a successful research and innovation ecosystem, 2019 is going to be a very important year for all three.

Related articles

Dr Martin Turner, Head of Policy and Public Affairs UK BioIndustry Association (BIA), delves into the Government’s proposed reforms of R&D tax relief system and the possible implications.

Emma Lindsell, Executive Director, Strategy, Performance and Engagement on the challenges and opportunities facing UKRI with the latest budget allocations.

Read our latest piece from Isobel Stephen, Executive Director, Strategy, Performance and Engagement at UKRI

Zoe Angel, Research Fellow at The Patrick G Johnston Centre for Cancer Research at Queen’s University Belfast, outlines how Northern Ireland can capitalise upon the UK Government’s ‘Place’ agenda