Revised business R&D statistics: what might this mean for the 2.4% R&D target?

05 Oct 2022

What have ONS done?

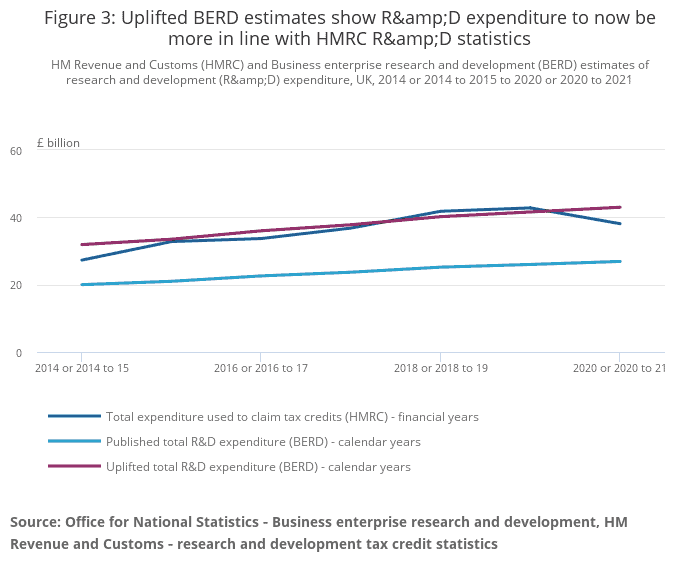

Last week, the ONS released the details of a new interim method for Business Enterprise Research and Development (BERD) statistics. BERD statistics are estimates of R&D performed by businesses, produced from an annual sample survey of 5,400 businesses in the UK. The new method is intended to reduce the discrepancy between ONS BERD statistics and HM Revenue and Customs (HMRC) R&D Tax Credit statistics. These HMRC R&D statistics are another source of data on R&D spending, consisting of administrative data of businesses that have applied for and received R&D tax credits. HMRC statistics have historically been higher than BERD statistics and have recently seen a larger rate of growth. The HMRC R&D statistics show R&D is increasingly conducted by smaller businesses. The interim methodological improvements for BERD aim to better represent smaller UK businesses within R&D estimates. This forms part of a wider programme of work to improve ONS R&D statistics, due to conclude in 2024.

The methodology was applied to published BERD estimates from 2014. Based on the revised figures, the new estimates show the value of R&D spending by UK businesses over this period to be much higher than previously estimated – £40.2bn, £41.6bn and £43.0bn for 2018, 2019 and 2020, respectively. Previous estimates have shown R&D spending at £25.2bn, £26.0bn and £26.9bn for the same period. This represents a substantial change in the level of business R&D, an increase of £15bn, £15.6bn, and £16.1bn, respectively.

Why better data is a good thing

The work to update methodologies is good news because it means we are measuring R&D activity more accurately. This in turn provides a more accurate picture of an evolving area of the economy and helps to give the most useful information possible to inform decision makers.

If the revised methodology proves to be robust, the new estimates have some important implications for research intensity projections in the UK. It appears that levels of private R&D investment are potentially much higher than originally thought. This suggests that current levels of public spending are more effective at leveraging private investment than current models have suggested. Reports published by CaSE and BEIS have shown the causal link between additional public investment in R&D and the amount of private investment that can be stimulated as a result of public spending. These reports have built models which analyse how varying levels of public investment will affect private investment. This is good news, as at CaSE we have always argued for the importance of private sector investment in reaching R&D targets.

What does it mean for our 2.4% projections?

These new estimates suggest that the UK may have already reached the Government’s target to spend 2.4% of GDP on R&D (which was based on the OECD average in 2018 – the OECD average is now at nearly 2.7%). CaSE had previously estimated the UK’s research intensity to be 1.94% based on previous R&D activity estimates.

It is too early to say exactly how these new R&D figures will impact on CaSE’s R&D projections or indeed wider R&D and economic statistics. BERD estimates feed into the Gross Domestic Expenditure on Research and Development (GERD) statistics, as well as the UK National Accounts outputs. Both of these rely on important economic statistics such as Gross Domestic Product (GDP). The ONS have indicated that the revised statistics could have an impact on GDP. But the impact is hard to quantify at this stage, and R&D is only a small component of GDP. We won’t fully know the impact until the next GERD release, scheduled for publication in November. CaSE will revisit its projections and look to update our model with these new figures.

What does it mean for wider political and policy work?

The new figures may mean the UK has already reached the intended 2.4% research intensity target, which is good news. But this does not mean that we should rest on our laurels if we want to keep and enhance this position. It just means we are measuring R&D activity more accurately. This should not be used by Government as a reason to not follow through on promised additional investment. In fact, these figures suggest that additional investment might be even more powerful because the new estimates suggest that the leverage ratio of public to private investment is even higher than we thought.

Now is the time to be ambitious and go for growth. At CaSE we have long argued to build on the current foundations and take the UK’s ambitions higher, looking towards a target of investing 3% of GDP into R&D – a level that would secure the UK’s place on the world stage. Our international competitors are pulling further ahead – OECD data shows that R&D investment as a share of GDP in the UK stands behind the leading R&D nations of Israel and South Korea who each spend over 4%, and countries like Germany, Japan, and Switzerland, who all spend over 3%.

But beyond investment targets, the principle of pursuing a more research and innovation intensive future is the right one. Investing in R&D is key for driving economic growth and prosperity across the UK. The new methodology does leave a lot of unknowns. At CaSE we look forward to delving into this more in the weeks ahead.

Camilla d'Angelo

Related resources

CaSE analysis of Government Expenditure on R&D (GovERD) statistics for 2023.

CaSE takes a look at the details of the DSIT 2025/26 spending allocations, including UKRI.

Analysis and highlights from CaSE’s research into public attitudes towards R&D and the Government’s missions.

This report sets out evidence on the integral role of R&D in driving progress on the UK Government’s missions.